One might think that the more competitive a field is, the lower your odds of success become. But when dealing with the Foreign Exchange Market, the opposite is actually true. More people trading money means more potential profits for you. However, you have to know how to take advantage of the opportunity. Here are some great tips on the topic.

Keep your eyes on the commodity prices. When they are rising, this generally means that there is a greater chance that you are in a stronger economy and that there is rising inflationary pressure. Avoid when the commodity prices are falling. This generally signals that the economy and inflation are falling as well.

As you get into trading in the Forex market, you need to begin to develop trading patterns. If you try to improvise, you can end up losing a lot of money. You should try to automate your trading so that you respond to certain situation in very similar ways.

Forex is all about the changing of money value. Therefore, it important that you study the markets and the fundamentals that cause price change between currencies. If you do not understand why the values are changing, how can you ever hope to make an informed decision on what currency to invest in.

When you are first starting out in forex trading, start with small investments out of a bank account that can be managed solely online. This prevents you from overextending yourself right away, as well as giving you the option to quickly add and remove money as needed to keep your trading afloat.

Remember that there are no secrets to becoming a successful forex trader. Making money in forex trading is all about research, hard work, and a little bit of luck. There is no broker or e-book that will give you all of the secrets to beating the forex market overnight, so don’t buy in to those systems.

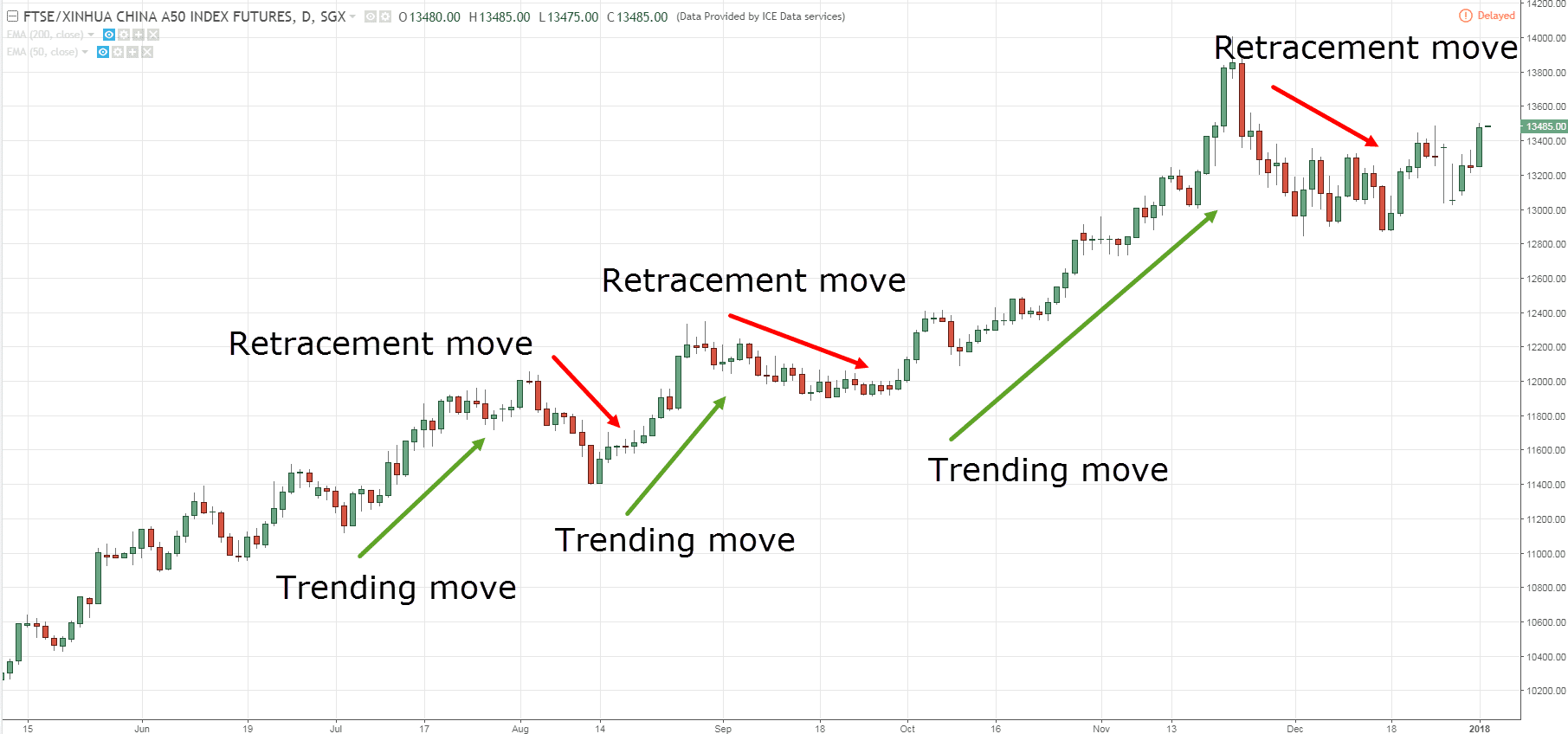

Try to mirror your strategy with the direction of the stock market on your page. If the market is in a downturn, leverage off of this and offer a sale. If things are on the rise, people are willing to spend more so increase your prices slightly. Trending with the market will increase your overall cash flow.

One thing people tend to do before they fail in their Forex is to make things far more complicated than necessary. When you find a method that works you should continue using that method. Constantly chasing new ideas can create so many conflicts that your Forex becomes a loser. Simple methods are best.

Investors in Forex will have much better luck if they actually spend their time trading with trends rather than attempting to play the tops and bottoms of markets. The latter may seem more appealing, as you may find that there’s more money in it for you if you win, but there’s also much more of a risk involved.

Having the proper knowledge of the market will ensure that you won’t lose your money. If you can learn more than the other people deciding to use Forex to profit, you can take full advantage of the crowded nature of this marketplace. Always use the tips you’ve learned here and never stop learning about Forex.